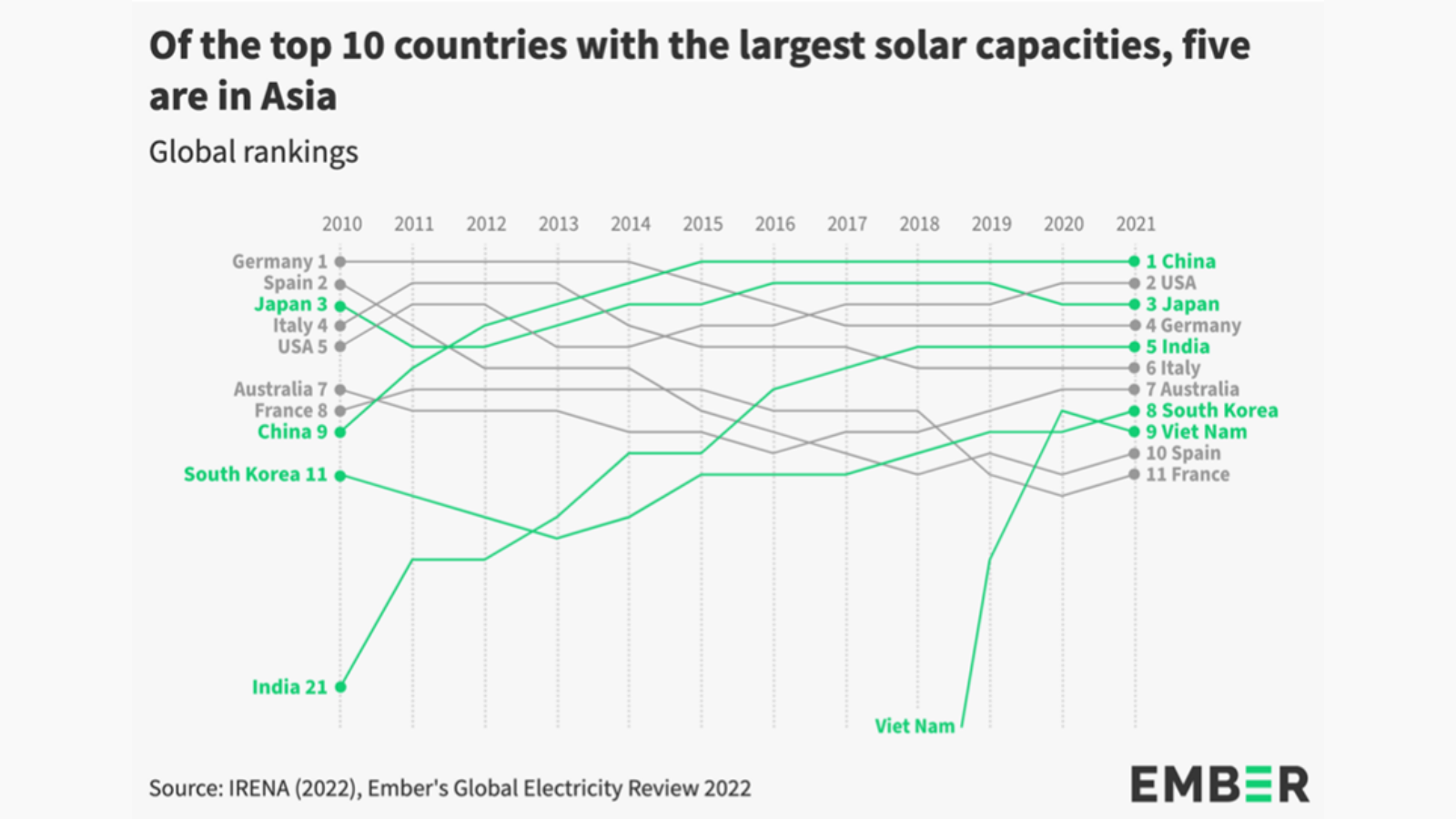

One of the many benefits of solar power is the speed and scale at which it can be deployed. But, despite this, some states still manage to exceed expectations. Viet Nam is one such place. In 2010, the South East Asian country was ranked 196th in the world according to its solar energy capacity. By 2021, Viet Nam had climbed to ninth in the global rankings, jumping above both Spain and France, an astonishing ascendancy.

In 2018, Vietnamese solar generation was close to zero TWh, but in 2022, solar accounted for 11 percent (14 TWh) of electricity demand from January to June. The rapid growth of solar throughout Viet Nam is estimated to have saved the nation $1.7 billion in potential fossil fuel costs – and this is without factoring in the human, social and environmental harms created through burning fossil fuels.

Viet Nam’s ability to rapidly scale up solar generation over the last decade is down to a combination of factors, including supportive government intervention, a positive policy environment and international collaboration. Targeted investment in key infrastructure was essential, and worked alongside a growing demand for cheap, secure, and clean energy from Vietnamese citizens and businesses. The foundations have been set for Viet Nam to continue its rapid growth in solar, climbing further up the global rankings.

Globally, solar generation continues to go from strength to strength. In 2021, after an additional 143 TWh of solar capacity added to the world’s energy mix, solar’s contribution crossed 1,000 TWh for the first time ever, contributing 3.7 percent to global generation. The growth in solar is unsurprising given it is, in the words of the International Energy Agency (IEA), ‘the cheapest electricity in history’. This is a result of rapid cost reductions as production scales-up and technologies improve, with the unit cost of electricity from solar declining by 85 percent over the last decade, according to the Intergovernmental Panel on Climate Change (IPCC).

At prices like these, solar is likely to continue being the most popular new energy generating technology. In 53 of the 112 nations Bloomberg NEF surveyed as part of their 2021 annual report, solar was the top technology added, up from just 14 percent in 2012. The IEA expects solar to surpass coal power as the largest source of global power generation by 2027. BloombergNEF expects annual solar PV demand to surge by more than 150 percent by 2030.

In 2023, solar demand is set to increase again by between 20 and 30 percent, with Russia’s invasion of Ukraine ‘turbo-charging’ investments in clean energy as countries around the world begin to acknowledge the geopolitical insecurities that arise from a dependency on fossil fuels. However, the good times for solar may be momentarily paused as supply chain bottlenecks and inflationary pressure through the value chain may halt further cost reductions. Polysilicon, a pure form of silicon that is vital for the creation of ingots which are then sliced into wafers to form solar cells and modules, is the main culprit for this supply chain crunch. Yet, global production is set to scale rapidly in response to this: there is 900GW of polysilicon capacity announced or under construction, more than twice BloombergNEF’s forecast for 2030.

As solar’s deployment increases, attention is rightly focussing on the resilience and sustainability of the supply chain and the lifecycle of solar generation projects. Manufacturing solar panels requires large amounts of heavy metals and caustic chemicals, which can have a range of environmental impacts on the local environment and the workers that work with them. On average, a solar panel lasts 30 years and, in order to remain sustainable, needs to be recycled. If humanity doesn’t scale up the facilities to reuse and recycle solar panels, by 2050 there could be 60 million tonnes of solar panel waste sitting in landfill, bleeding toxic chemicals into the soil and groundwater. Fortunately, a number of companies and concerned governments are seeking to address this problem, with some achieving a material reuse rate of up to 95 percent.

Viet Nam’s ascendancy into the top ten global solar generators must be placed in the wider regional context of Asia. A rapid transition towards renewable energy is currently underway across the Asian continent, with five Asian states now among the top ten solar powered countries globally. Just a decade ago, only two Asian states made the top ten while Europe dominated the market. But now, India, Viet Nam, South Korea, Japan and China are all firmly in the top ten. There’s no sign of solar slowing across Asia either. Solar capacity is expected to grow at a rate of 22 percent per year up to 2030 in China, India, the Philippines, Japan, and Indonesia.

The rapid transition towards renewable energy in Asia is of critical importance to global climate action. Asia currently accounts for almost half of global energy demand, and despite its huge gains in clean energy generation, it remains one of the highest emitting regions. Demand for electricity is also growing in Asia at a much higher rate than anywhere else in the world. Between 2010 and 2021, the global demand for electricity grew by 31.8 percent. Yet, over the same period, Asian states reported much higher rises in demand for electricity: China’s rose by 102 percent, India saw a rise of 82 percent, and Indonesia experienced an increase in demand of 75 percent. However, it was Viet Nam that experienced the greatest increase in electricity demand: recording a 125 percent increase.

As Viet Nam – and many other Asian states – are net-importers of energy, the recent volatility of energy commodity markets and the subsequent price hikes have cost them dearly. The vulnerability that comes with being exposed to global markets has galvanised efforts to shift towards home grown renewables. But ensuring that this rapidly increasing demand for energy is met through clean generation will require international collaboration. This may come in the form of the recently signed Just Energy Transition Partnership (JET-P) deal between Viet Nam and the “International Partners Group” (IPG) consisting of the EU, UK, US, Japan, Germany, France, Italy, Canada, Denmark, and Norway.

The partnership will see $15.5 billion mobilized over the next three to five years, made up of public sector finance and private sector finance in the form of grants, low interest loans, and investment. However, there are concerns – as noted by Global Witness – that this deal lacks transparency and civil society engagement; two essential elements for a just and rapid transition. This is particularly important in Viet Nam, where climate activists and legal experts continue to be arrested due to their advocacy efforts around land rights and climate justice.

As with any rapid deployment of renewable energy technologies, the policy mix is key. The meteoric rise of solar power in Viet Nam, which provided over 11 percent of the state’s power in the first six months of 2022, was made possible through a generous feed-in-tariff (FIT) in long-term power purchase agreements with Viet Nam Electricity (EVN). Founded in 1994, EVN is a state-owned energy company and is the largest provider of power within Viet Nam, giving it the scale and resources to dramatically restructure the country’s energy mix. The first FIT was introduced by the Vietnamese government in 2017 which enabled solar power projects – both utility scale and rooftop – that started generating before June 2019 to sell their electricity to EVN at a price of $93.5 per MWh for 20 years.

At the time, this was the most generous FIT in the whole of Southeast Asia. For instance, the FIT for rooftop solar in Thailand in 2019 was around $57 per MWh. The motivation behind such a generous FIT was to reduce the risk of power shortages which had plagued the country for years while larger fossil-fuel projects suffered from delays in the construction process. In terms of speeding up the deployment of solar energy, the policy was an undoubted success, with investors, businesses, and citizens piling in to build projects. In the month of December alone, in 2020, nearly seven gigawatts of root solar was installed – an unparalleled achievement.

At a utility scale, the Vietnamese government has opened up the electricity market for bilateral power purchase agreements – known as PPAs – to reduce the monopoly of EVN and galvanise more investment and competition within the market. In a similar push, solar power generators can now sell directly to consumers or other power providers, reducing EVN’s hold on the market.

Alongside FITs and greater market competition, the Vietnamese government exempted solar (and wind) generators from corporate income tax for the first four years of operation, with a 50 percent reduction for the following nine years and then a 10 percent cut until the fifteenth year of operation. The technologies and hardware were also exempted from import tariffs too and certain solar generators also benefited from land lease payment exemptions depending on their location.

Building utility scale solar farms and installed modules on rooftops has delivered serious dividends for Vietnamese citizens – but there is a limit. At a certain point, clean electricity generation will be limited by the capacity to transmit it from the point of generation to where it is being consumed. This can lead to high levels of curtailment, where electricity is effectively wasted as it cannot be distributed.

Investing in transmission and distribution infrastructure is a vital part of rapid transition. But it takes time. In Viet Nam, the average time for completing a grid expansion project is three years. However, to commission and install a solar PV project in Viet Nam takes an average of nine months. This is clearly an issue that will hold back the gains being made by solar throughout the country.

In response to this, the government has launched a number of initiatives and projects to upgrade and expand the transmission network. By 2030, the total capital investment into power grids will be around $33 billion – just over $3.3bn a year. This investment will cover the construction of new transmission lines and substations, as well as the deployment of smart grids and other emergent technologies. The Vietnamese government is also in the process of trying to court private investment into the grid infrastructure to speed up its expansion so more wind and solar can come online.

Solar has quickly emerged as a cheap, reliable and clean source of electricity for Vietnamese citizens. With incomes rising and the Vietnamese economy growing, many businesses and households can now afford to install rooftop solar. Public support was also buoyed by concerns over air pollution – an issue that is expected to kill 650,000 ASEAN citizens every year by 2040 if the region pursues fossil fuel dependency. The localised health benefits associated with clean electricity generation, combined with the generous FITs and tax breaks, have led businesses and residents to install solar modules anywhere they can.

By the end of 2020, when the second round of the FIT closed, there were over 101,000 rooftop solar systems installed across resident, commercial, and industrial buildings throughout Viet Nam. This is a massive 25-fold increase on installed capacity the year before. While the roll out of solar – both utility and rooftop – has defied expectations, there are still issues to overcome. Financing options for lower income groups have not materialised, creating a gulf in access to clean and reliable energy. However, a variety of Fairtrade accredited businesses across Vietnam have formed clean energy cooperatives to help build capacity and increase deployment. Solar cooperatives have also popped up to increase electrification in rural Vietnamese communities. What’s more, with the demand for rooftop solar systems growing, there are concerns that the current supply chain may falter, driving delays and pushing targets further out of reach.